by Karen Turnquist

“While the yield curve has not yet inverted, the bond market is telling us that the odds of a recession are increasing.”

—Neel Kashkari, Minneapolis Fed President, Dec. 18, 2017

************

“We expect the U.S. economy to continue to expand at about 2.5% in 2018, supported by improved business spending, better global growth, and business-friendly fiscal policy.”

—The Weekly Economic Market Commentary, Dec. 11, 2017

So, which is it? Economic disaster or full-steam ahead?

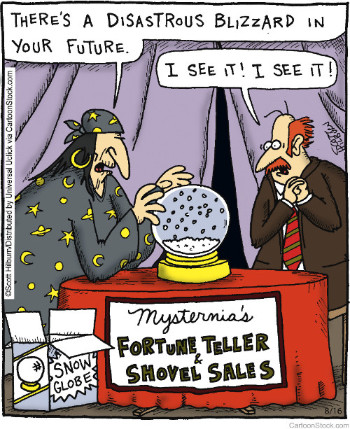

A look into my own crystal ball (aka historic economic data) tells me the answer is both.

The Dow hit a record high last week—going above 25,000 for the first time ever. But at some point, inevitably, the economy will slump, markets will suffer a “correction” and valuations will fall.

And when it does, business owners will find reaching their business objectives is much more difficult.

So where does that leave us now?

Lessons from 2008

Just as we can learn from historic economic data, we can also learn from the actions of business owners in the wake of past recessions.

The enduring lesson from my work with entrepreneurs during the 2008 recession is that the actions business owners took in response to the economic downturn were, by their own admission, things they should have been doing all along.

Once the economy began to recover, and business owners were able to reflect on what they had done or wished they had done, I heard many of the same observations.

Here is a recap of some of my favorite laments from business-owners at the conclusion of the last recession:

Before the last recession hit, business owners wished they had…

- a break-up talk with customers that were borderline profitable because they bloated the business’ overhead and drove up their investments in inventory.

- fired the employees that weren’t the best fit and done a much better job of taking care of the employees who ultimately became the backbone of the business’ recovery. Owners also wished they would have offered more training, profit sharing and team building through service projects and other company-wide fun.

- created deep roots by being rigorous about defining purpose, values, brand, vision and mission—the things that would sustain them and keep them together through challenging times.

- tied up a lot less money in inventory, which became even more difficult to sell once the recession took hold.

- written off old inventory in years when there was income to offset the losses.

- not waited to cut discretionary spending until it was an imperative, but rather consistently and carefully considered the ROI of each and every expense.

- gotten serious about expanding their customer base beyond a few key accounts.

- been satisfied with slower growth based in greater part on internally generated working capital, relying less on leverage and loans from banks.

- listened more, been more vulnerable and transparent and stopped the “it’s-up-to-me” thinking. They wished they had asked for more help and collaborated with employees, customers and vendors. In short, they wish they would’ve become servant leaders and developed an unstoppable team approach to recovery and rebuilding.

- eaten better, got more exercise, drank less alcohol, got more sleep, watched funny movies, took their spouses on dates and practiced more gratitude. (You know, all the things your mom, your spouse and everyone who loves you always says you need to do.)

My best advice: Don’t wait until the economy slumps before you take the steps necessary to make your company healthier and better equipped to withstand the pressures, burdens and challenges of a downturn.

Fulfill your commitments as a leader. Have the foresight and discipline to plan for and execute strategies that find opportunity in adversity and shine the light of optimism into the future.

As the CEO and founder of Sage Business Credit, Karen Turnquist helps entrepreneurs build value in their businesses. She’s facilitated more than $2 billion in accounts-receivable financing for emerging businesses and believes there’s no greater reward than seeing fellow entrepreneurs succeed.